Stop relying on clunky Aged Invoice Reports and handwritten notes.

Use Sage CRM to better manage collection calls and follow-ups and make sure sales and accounting are in synch.

Prevent errors, increase efficiency, and get Sales and Accounts Receivable on the same page!

If you’re still using the clunky process of tracking collection call notes and follow-ups in the margins of an Aged Receivables report, there is a better way. By using Sage CRM to manage your receivables, you can ensure your accounting and sales teams are on the same page and ensure follow-ups get done on time.

A lot of people think of CRM as a tool to manage sales, services, or marketing. And that’s true! CRM is incredibly valuable for managing those aspects of your business.

It can do more, though. Using Sage CRM to effectively manage your receivables process helps you get organized, avoid errors, and ensure everybody on the team is aware of the calls that are being made, who’s making them, and the responses you’re receiving.

Over time, you can run analytics on your AR activities to create processes or even full automation points to streamline your work.

Watch the video below to see what Sage CRM can do for your AR processes:

Time to retire Aged Invoice Reports

First, let’s talk about how you are probably doing receivables right now.

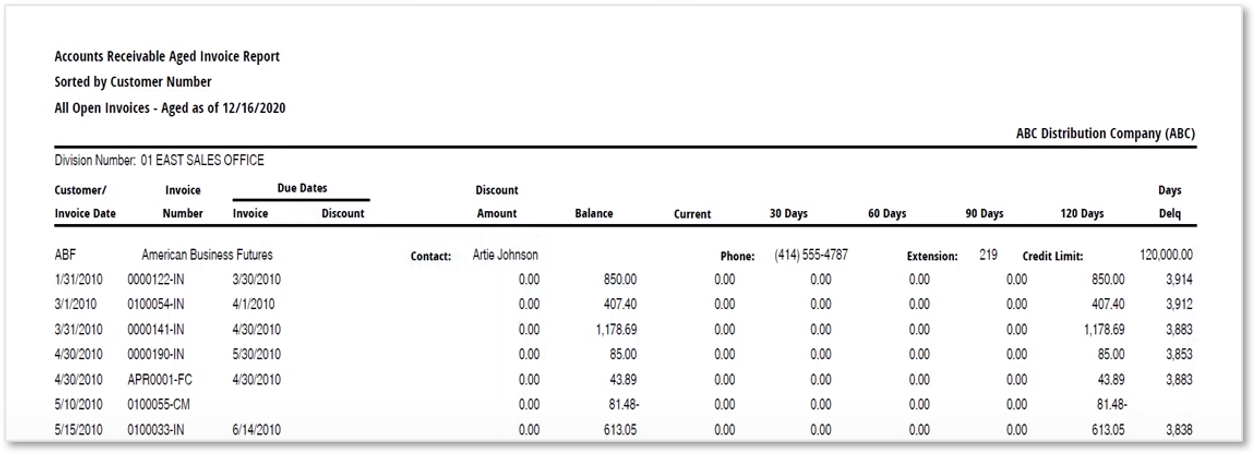

A lot of companies start with an Accounts Receivable Aged Invoice Report, which gives you a list of all your accounts, what kind of outstanding balances they have, for how long by date, etc:

Once you print and review this report, you make your calls to say, “Hey, what’s going on with that bill?” and Artie, Tony, and Winnie here tell you their stories. The check may be in the mail. They may be disputing a payment. And so on.

As you talk to each customer, you might write notes in the margins of the report. You might enter notes into a spreadsheet. You might take notes in your Outlook calendar.

But there are 3 big problems with the traditional approach:

- It’s a pretty clunky process

- It’s easy to miss things

- Your salespeople aren’t in the loop

So for example, if I’m a salesperson working with one of these customers, I may not know that you just had a collections call with them. And depending on how that call went, you may have upset my customer—or it may be that they upset us because they owe us some money and have not paid for a long time!

Either way, it’s better to have an integrated process.

That’s where CRM comes in.

Streamline the collection process!

CRM allows you to track these things efficiently and effectively.

Let’s take a look at how:

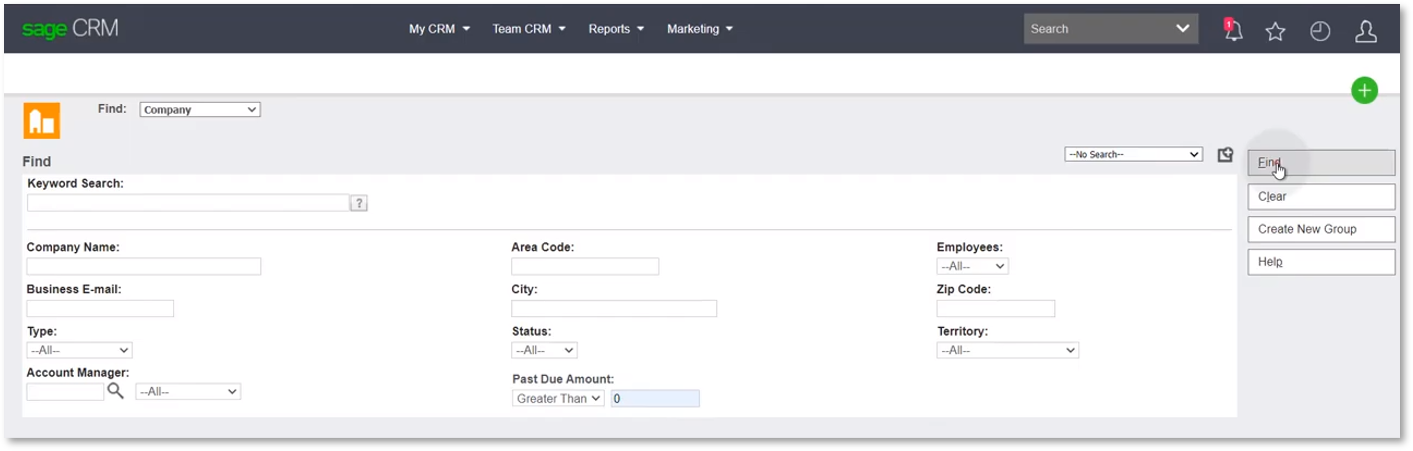

To do so, start a customer search based on the criteria and thresholds that matter most to you:

You might want to find everyone with a past due amount greater than zero. Or you might want to find everyone with over $1,000 past due. You might also want to filter by days outstanding to get only people over a certain amount of time.

These are very specific details that depend on your needs, and we can help you sort those out. But for now, in my example, I’m going to find everyone with greater than zero dollars past due right now.

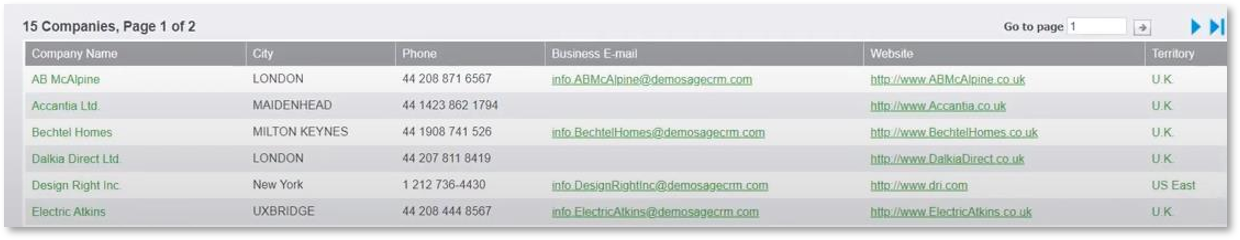

I get back a list of 15 customers who owe us money:

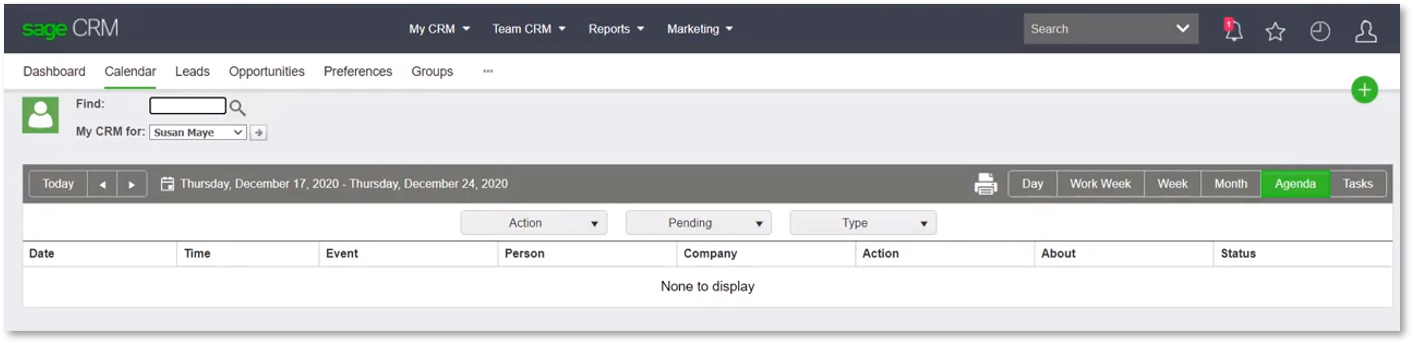

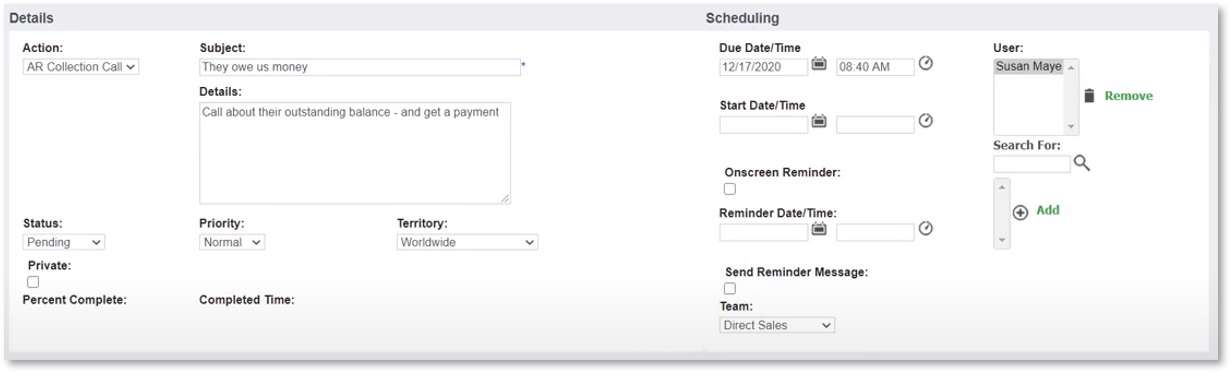

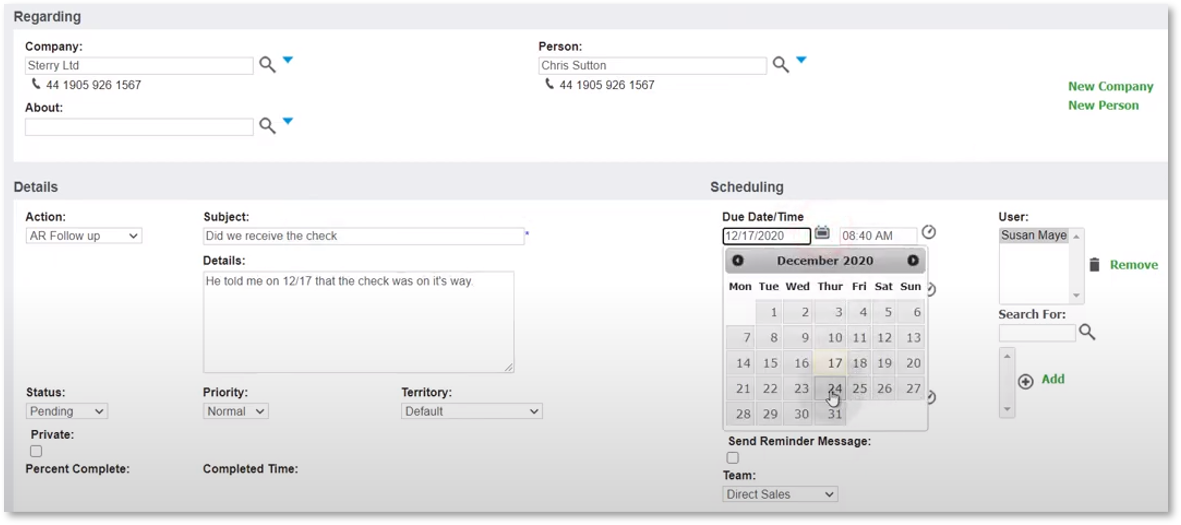

I’m going to set up a new collection call task for Susan so she knows to call these people today:

Next, I need to assign the task to myself or my coworkers. Who gets it depends on your organization: who makes these kinds of calls? Account managers? Salespeople? Whoever it is, we want to assign these tasks to them.

I can also choose when and how often these calls are made. Since in this example we only have 15 calls to make, it’s reasonable to put them all onto today’s agenda. But if there were more, we could spread these tasks across a team and/or multiple days to balance the workload better. If we know the best time to contact particular customers, we can set that as well.

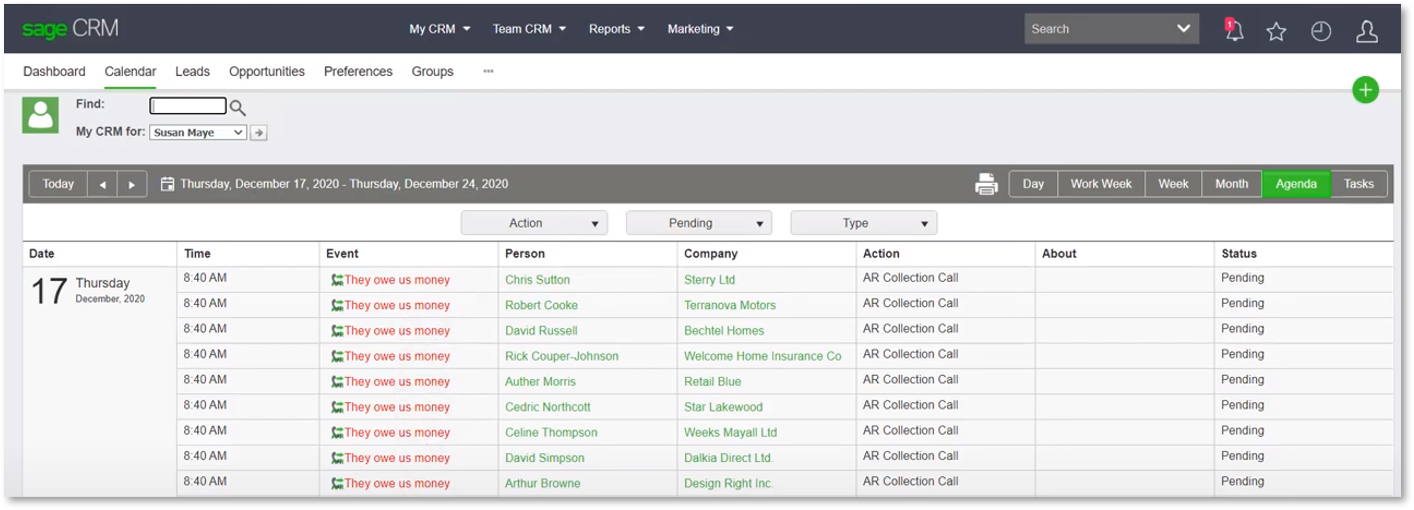

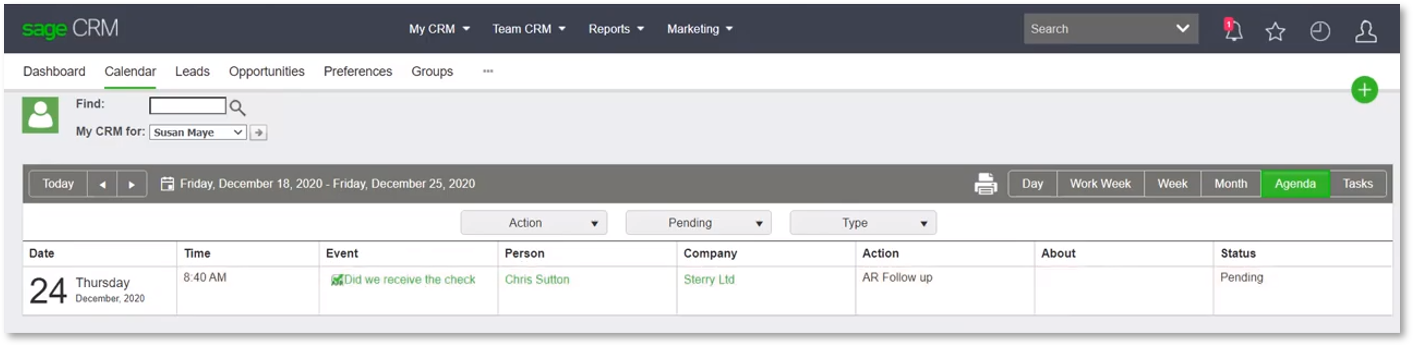

Once I hit save, the system will create those 15 tasks and those calls will be scheduled for Susan. So when Susan goes back to her calendar, she’ll see she needs to make these calls and can easily work this call list with all the information she needs at her fingertips:

Never forget to follow up!

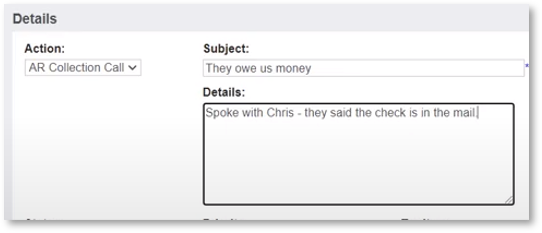

Of course, we’ve all heard that the check is in the mail. What matters is whether it actually makes it to us!

And if you consistently get the same responses, you can automate your responses. So if the check is always in the mail, you can create automations to automatically add AR follow-ups when that status is selected.

That’s a really powerful way to save time and stay organized and on top of these things.

Keep Sales in the loop!

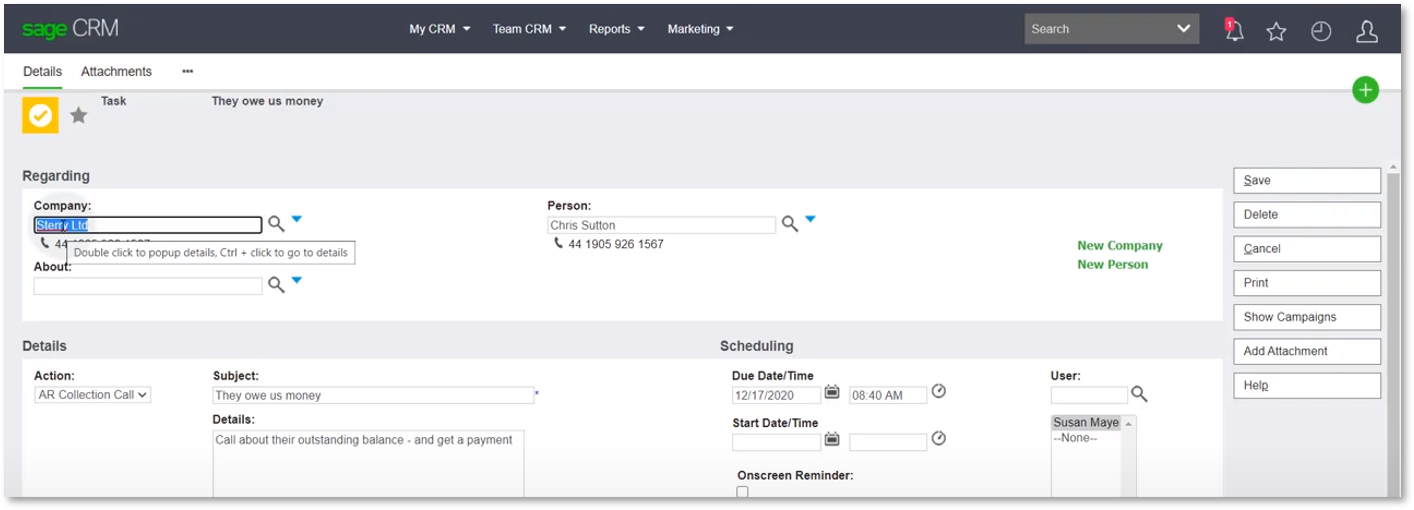

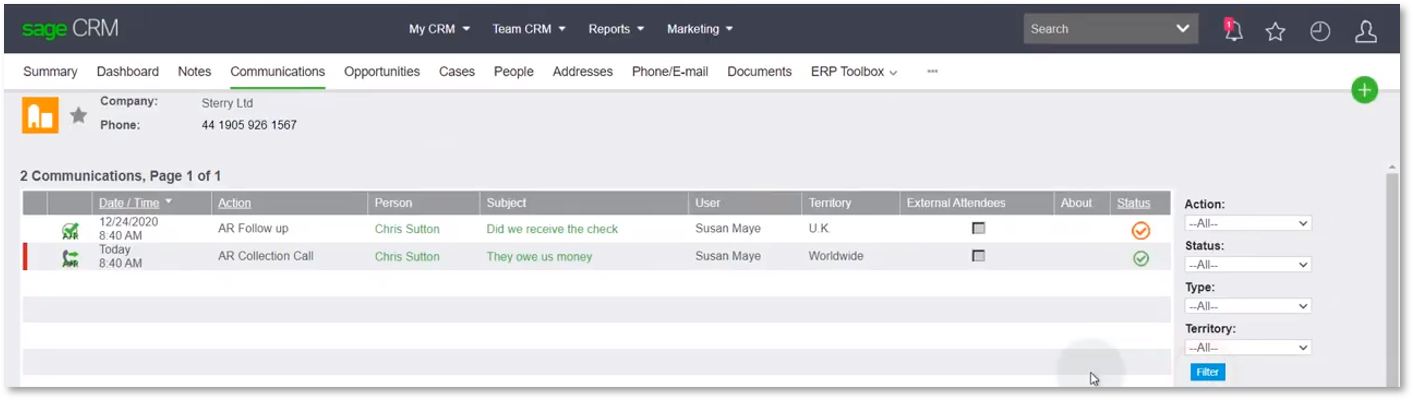

Another important part of using CRM to manage receivables is the visibility it provides to your sales team. So, if I’m an account manager and I’m not usually aware when my AR clerk is calling on my accounts, I can see those AR follow-ups in my customer records:

And if I look deeper into all the activities we’ve had, I can see that Susan made a call today about the money my customer owes us. I can also see how that call went, and adjust my next sales call if needed.

What can Sage CRM do for your business?

Hopefully that gives you a good, high-level sense of how Sage CRM can help you.

Would you like to learn more about whether Sage CRM would be a good fit for your business?

Let’s talk!

Peter Wolf is the president and founder of Azamba. He has spent the last 18 years focused on helping small and medium-sized businesses become more profitable through effective and efficient usage of CRM.

His passion is blending the promise of CRM with the realities of business needs to create successful outcomes.